Every year, the Internal Revenue Service announces the contribution limits for retirement plans, including 401(k), 403(b) and 457(b) plans. As you review your finances, it is important to consider your retirement plan contributions, too.

Contribution limits for 2022

In 2022, the total amount you may contribute as a salary deferral is the lesser of 100% of compensation or $20,500. If you are age 50 or older, you may be able to make an additional catch-up contribution of up to $6,500. (403(b) and 457(b) plans may offer additional catch-up contributions.) Check with your employer for specifics. All limits are subject to change in future years.

Save taxes now or later?

What if your retirement plan offers a choice of pretax and Roth contributions? If you decide to make pretax and Roth contributions to your retirement, then the annual limit above applies to the combined total. Below are other considerations when choosing between these types of contribution:

• Pretax contributions can help you save taxes now

With pretax contributions, your take-home pay is reduced by less than your total contribution and you benefit from an immediate tax reduction.

• Roth contributions can help you save taxes later

With Roth contributions, your take-home pay is reduced by your contribution amount since these are made with after-tax dollars. However, withdrawals of earnings on Roth contributions are not subject to income taxes if you are at least age 59 1⁄2 and have held the account for 5 years or more. Additional rules may apply. Roth contributions could be valuable if you expect your tax rate to be the same or higher at retirement than it is now, you want your beneficiaries to receive tax-free distributions, or you are currently in a relatively low income tax bracket and are more interested in tax-free distributions later than tax deferral now.

Example of pretax savings

If you contribute $115.38 weekly (i.e., $6,000 a year) to your retirement plan, you will only forgo $86.53 in spendable dollars if your tax rate is 25%. This will potentially save you $28.85 in federal income taxes with each paycheck.

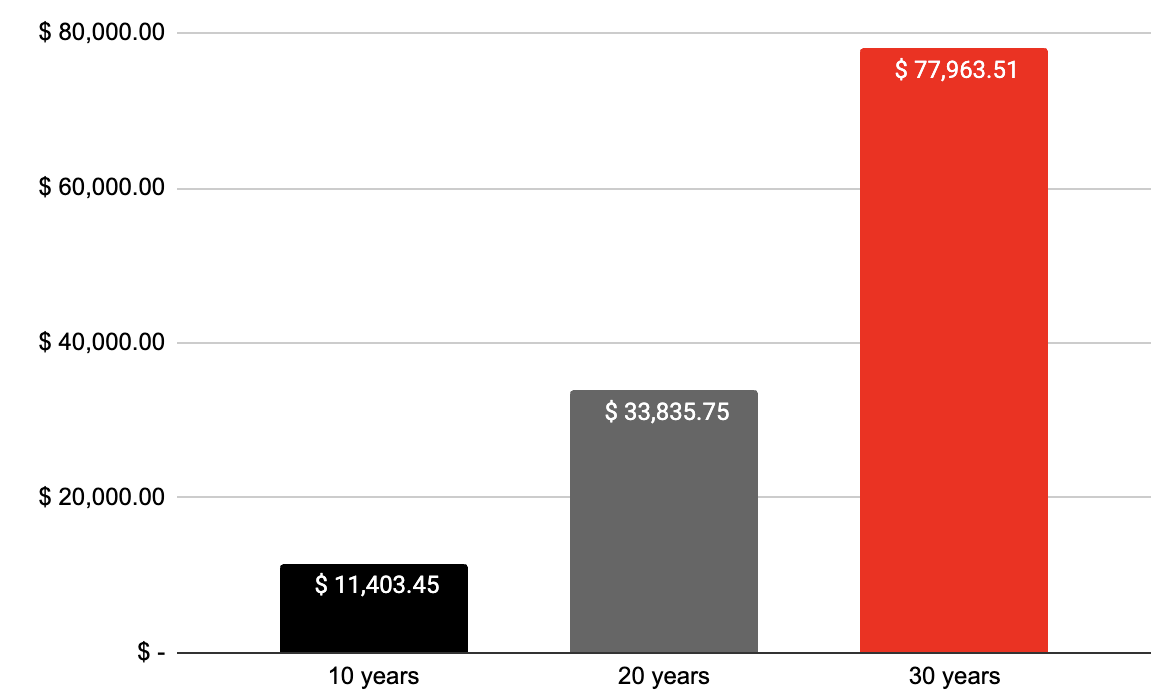

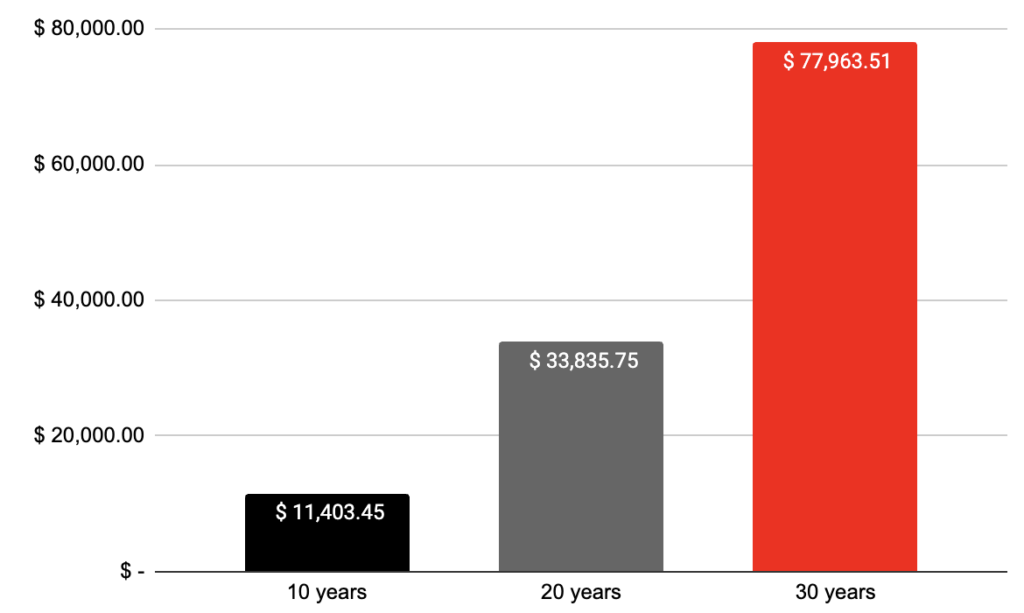

Consider increasing your contribution by 2% each year

Increasing your current contribution can make a big difference in the ability to grow your account over the long term. And, because your contributions benefit from tax-deferred compounding potential, they have the opportunity to grow faster than they would in an account that taxes earnings every year. The example on the right shows how a 2% increase can potentially turn into substantial retirement savings over 10, 20 and 30 years.

How 2% can turn into substantial retirement savings

Here’s a hypothetical example of how an extra 2% contribution each year can grow over time. Remember, every dollar you contribute to the plan benefits from tax-deferred compounding. In addition, if you have an existing account balance, contribute more than 2% or your plan has a company matching contribution, your results could be greater.

What’s an ideal contribution rate?

How much you contribute to your retirement plan each month will depend on several factors, including your salary, financial obligations and number of years until you plan to retire. Your financial professional can also assist you with determining an appropriate retirement savings goal and contribution rate.

2% retirement plan contribution — $800 annually

Assumptions: 2% annual pretax retirement plan contribution made for time periods indicated. Salary used for example is $40,000 and assumed growth rate is 7% annually. Please keep in mind that rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk. This example does not take into account the effect of investment management fees, product-related fees or taxes. Source: mycalculators.com, 401(k) Calculator.

Take action: Your retirement plan offers the flexibility to change your contributions (check with your employer for specific rules). If you have questions about your plan or want to change your contributions, contact your benefits office or financial professional.